Small Savings Schemes: To open PPF and RD account in the post office, there is no need to fill paper form, rather the account can be opened easily through Aadhaar based biometric e-KYC.

Post Office Schemes: The post office is constantly changing its rules for the convenience of its customers. In this sequence, the Department of Posts has now changed the rules related to Recurring Deposit (RD) and Public Provident Fund (PPF). The department has made this amendment to make it easier for the customers to access its facilities. Under this new change, customers will not have to fill paper forms to open PPF and RD accounts in the post office, but the account can be easily opened through Aadhaar based biometric e-KYC. Let us tell you that this system has come into effect from 27 June 2025.

The facility was already applicable in these schemes

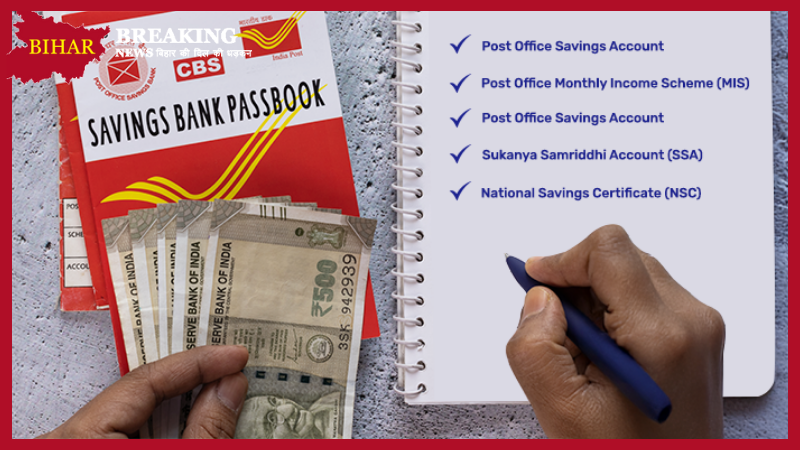

Earlier, through Aadhaar based e-KYC, there is a facility to open an account in only a few schemes, which include savings schemes like Monthly Income Scheme (MIS), Time Deposit (TD), Kisan Vikas Patra (KVP), and National Savings Certificate (NSC). Now this facility has also been implemented for Public Provident Fund (PPF) and Recurring Deposit (RD). The purpose behind this move of the Dock Department is to promote digital banking in rural areas.

How to open an account through Aadhaar biometric?

Let us tell you that it is very easy to open or manage RD and PPF account in the post office. The post master will first scan the fingerprints or eyes of the customer. After this, the details required to open the account will be entered. After filling the details completely, the second biometric of the customer will be taken to confirm the transaction. This will end the process of filling the paper form and the customer’s account will be activated within minutes.

Facility available in most schemes of post office

It is worth noting that the post office started Aadhaar based e-KYC from 6 January 2025. During this, the department started the onboarding of Post Office Savings Accounts (POSA) for new customers. After this, this facility was also started in schemes like MIS, TD, KVP, and NSC from 23 April 2025. Now with the inclusion of RD and PPF, most of the small savings schemes of the postal department have become digital.

Most Read Articles:

- UPI Bank : Open an account in this bank without any documents, withdraw cash whenever you want

- iPhone Bumper Discount : No EMI, get the latest iPhone for Rs 35,000 in Prime Day sale, know how to buy

- 8th Pay Commission: Central government employees’ salary will increase by up to 34%! See report